How Much Does Peace of Mind Cost? Comparing Term and Whole Life Insurance in 2025

Life insurance decisions can shape your financial future just as much as picking a home, job, or college. The stakes are real—protecting a family’s dreams, locking in a legacy, and planning for what-ifs that everyone hopes won’t happen. But let’s get honest. Most people care most about the cost. The two main choices—term and whole life—come with prices that can steer not just your budget, but the options you have for saving and spending every month.

Breaking Down the Costs: Term Life versus Whole Life

Photo by RDNE Stock project

Photo by RDNE Stock project

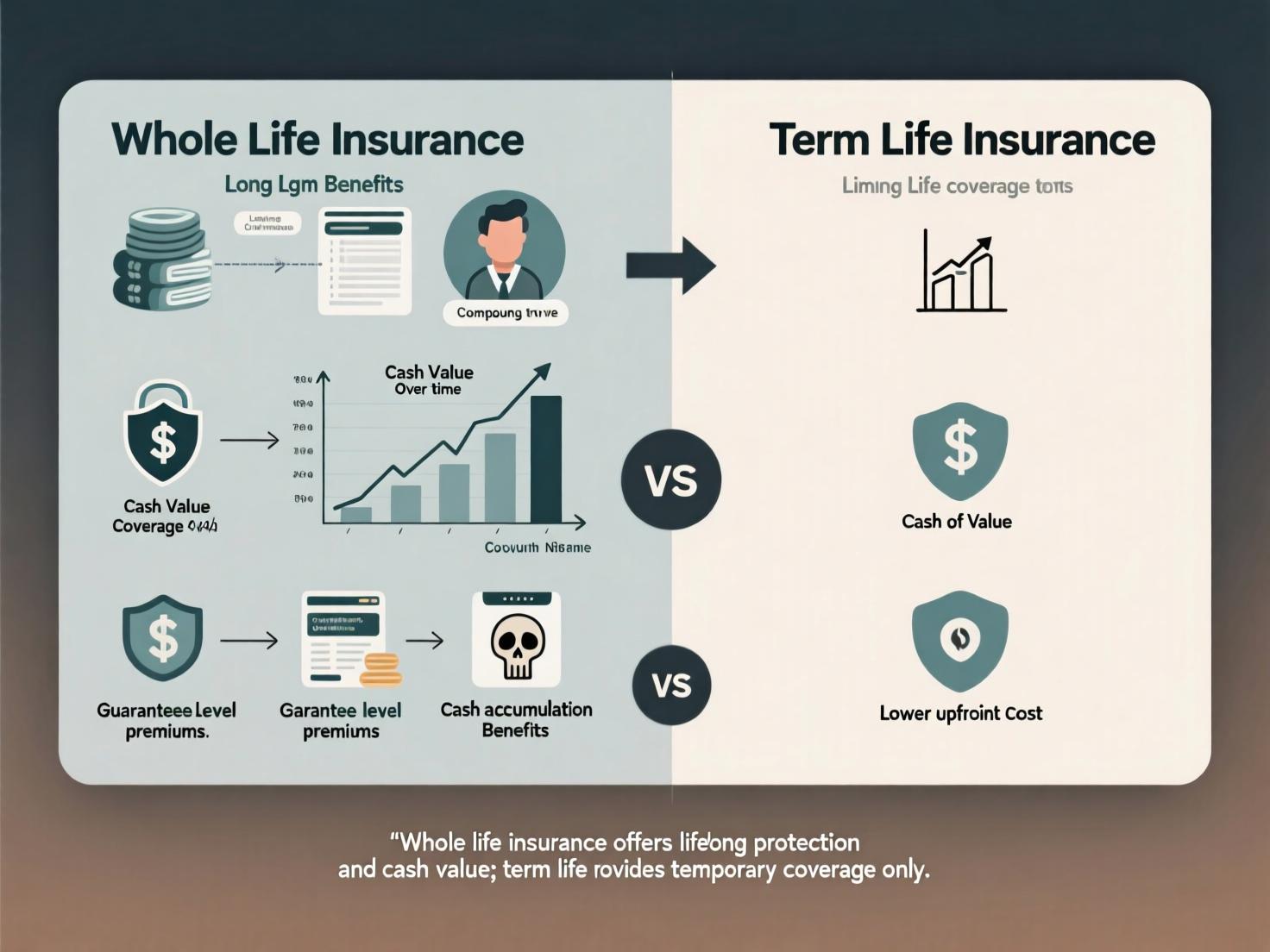

Term life and whole life insurance are nothing alike when it comes to structure, cost, and benefits. Term life keeps things short and simple, covering you for a set number of years—often 10, 20, or 30. Whole life is there for you until your last day; it’s permanent and adds a slow-growing savings bucket called “cash value.”

Current price check for 2025:

- Term life insurance: A healthy 30-year-old might pay just $22 to $33 a month for a $500,000, 20-year policy.

- Whole life insurance: The same person faces $225 to $440 monthly for a $500,000 policy—often more than ten times the term price.

Costs jump as you age. At 50, a $500,000 term policy could cost $60 a month, but whole life can rocket past $540 for the same coverage.

Why Term Life Tends to Cost Less

Term life is like renting. You pay to be covered for a stretch of time, then the coverage ends. There are no savings features or extras, just pure financial protection. If you don’t pass away during the policy’s term, the insurance company keeps the premiums.

For a healthy non-smoker aged 30:

- $500,000 in coverage for 20 years could run $22 to $33 a month.

- Rates jump with age. At 50, that climbs to around $58.

Why it’s cheap:

- The odds of the insurer paying out are low.

- No built-in cash value or investment features.

- Simple policy design (just payout on death within the term).

Why Whole Life Costs More

Whole life insurance is like buying a house. Your premiums are higher, but part of each payment goes into a savings pot—the cash value. Plus, your coverage never expires. Whole life is almost always more expensive, since the insurer will pay the death benefit eventually.

Cost example for 2025:

- At age 30, $500,000 of whole life coverage can cost about $440 per month.

- At age 50, it often surpasses $540 per month, sometimes higher for new applicants.

Why it’s pricey:

- Guaranteed payout whenever you die.

- Cash value grows over time, tax-deferred.

- Policy is more complex, blending insurance and savings.

Factors That Shape What You’ll Pay

It’s not just policy type that shapes your insurance bill. Insurers size up each applicant by several factors that add up to the final price tag.

How Age, Health, and Coverage Amount Shape Premiums

- Age: Costs are lowest if you lock in coverage when you’re young and healthy. A 30-year-old’s premium might be less than half what a 50-year-old pays for the same policy.

- Health: Non-smokers with clean bills of health grab the best rates. Smokers often pay double.

- Coverage amount: The bigger the death benefit, the bigger the premium.

- Gender: Women usually pay less due to longer lifespans.

- Other factors: Hobbies, job risks, and even family health background can nudge costs up or down.

Example: A healthy 30-year-old non-smoker pays $33/month for a $500k term policy. At age 50, the same person could pay over $58 for term, or $540+ for whole life.

Cash Value, Dividends, and Flexibility: Added Features That Impact Cost

Whole life brings bells and whistles:

- Cash value: A chunk of your premium is saved and grows over time. You can borrow against it or withdraw it.

- Dividends: Some whole life policies pay dividends once a year, which you can take as cash or pour back into the policy.

- Policy loans: Need cash? Borrow from your own policy, but pay it back with interest. Unpaid loans reduce the death benefit.

These add-ons are helpful, but they’re not free. Expect to pay higher monthly premiums for added flexibility and long-term value.

Deciding What’s Right for You

The right fit comes down to needs, budget, and longer-term money goals. Term life wins for affordability, but whole life can double as a steady savings plan.

Think about:

- How long you need coverage.

- Your family’s needs if you’re not around.

- Whether you want forced savings or estate planning built-in.

- How much wiggle room you have in your monthly budget.

When Does Paying More Make Sense?

Whole life’s higher premium can be worth it:

- If you want to build savings or borrow against your policy for emergencies.

- For legacy planning, passing wealth or covering estate taxes.

- When you value guaranteed coverage, no matter how long you live.

- If your health could decline and you want protection no matter what.

When to Stick with a Budget-Friendly Option

Term life shines when:

- You have kids or a mortgage and just need a timed safety net.

- You want the most coverage for the lowest cost.

- You don’t need permanent savings or cash value.

- Your main goal is income protection until retirement.

Conclusion

Term life and whole life serve different needs—and come with very different prices. Term is often the smart, affordable step for growing families or anyone watching the monthly wallet. Whole life costs more but can become a lifelong asset.

Think about your stage in life, your budget, and the future you want for your loved ones. The best choice makes you feel confident, protected, and prepared for what’s ahead. Start reviewing your needs today, and take that next step with purpose.